Louisiana homeowners are feeling the pinch as the cost of homeowners insurance continues to rise. Louisiana Insurance Commission Tim Temple recently touted reforms meant to reign in the cost of insurance in a Times-Picayune | NOLA.gov editorial. Homeowners insurance premium and claim data supplied from the Louisiana Department of Insurance over the past 20 years highlights key trends driving Louisiana’s insurance crisis.

Here are the five big trends driving homeowners insurance in Louisiana.

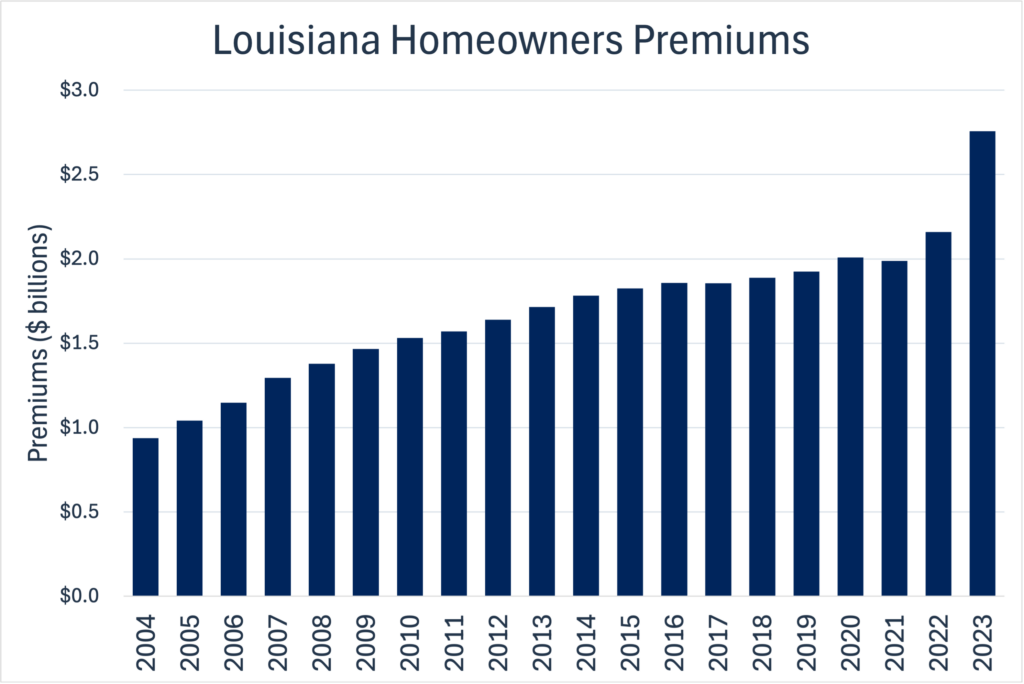

#1: Premiums increased 28% in 2023

Homeowners witnessed the largest increase in premiums in the past two decades, reaching $2.7 billion in 2023. This represents a 28% increase from 2022, which itself saw a 9% increase in premiums. In contrast, the average annual increase in the previous 18 years was just under 5%.

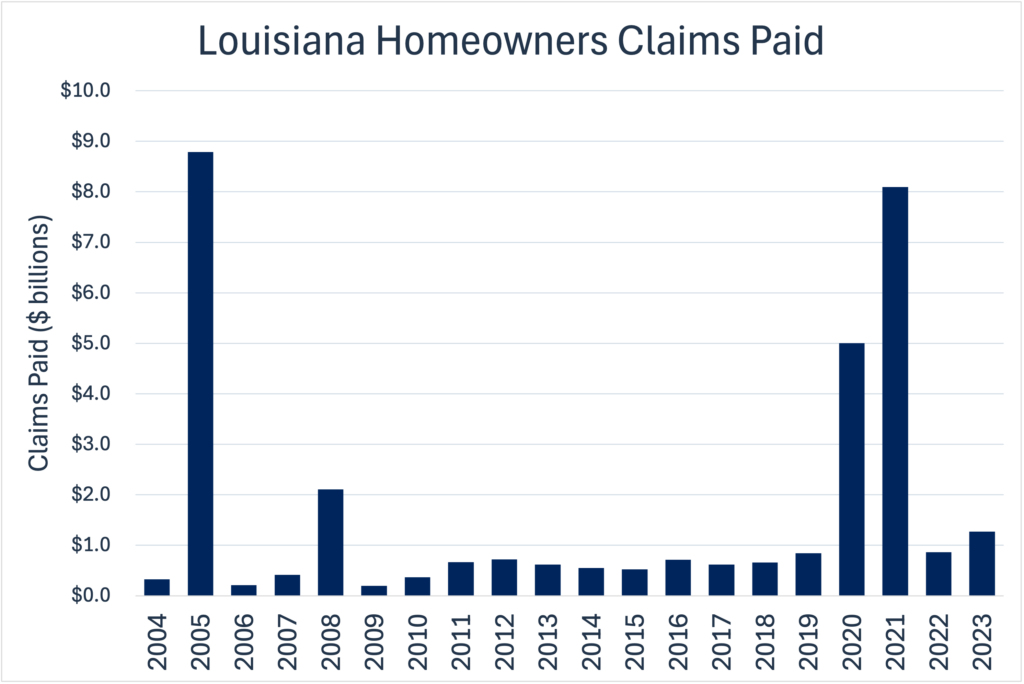

#2: Insurers faced back-to-back years of record claim payouts

Insurers recorded two years of record claim payouts in 2020 and 2021, exceeding $13 billion. This was due to severe weather events, including Category 4 Hurricanes Laura and Ida and Category 2 Hurricane Delta. (Both these years, however, still don’t top 2005 payouts due to Hurricane Katrina!)

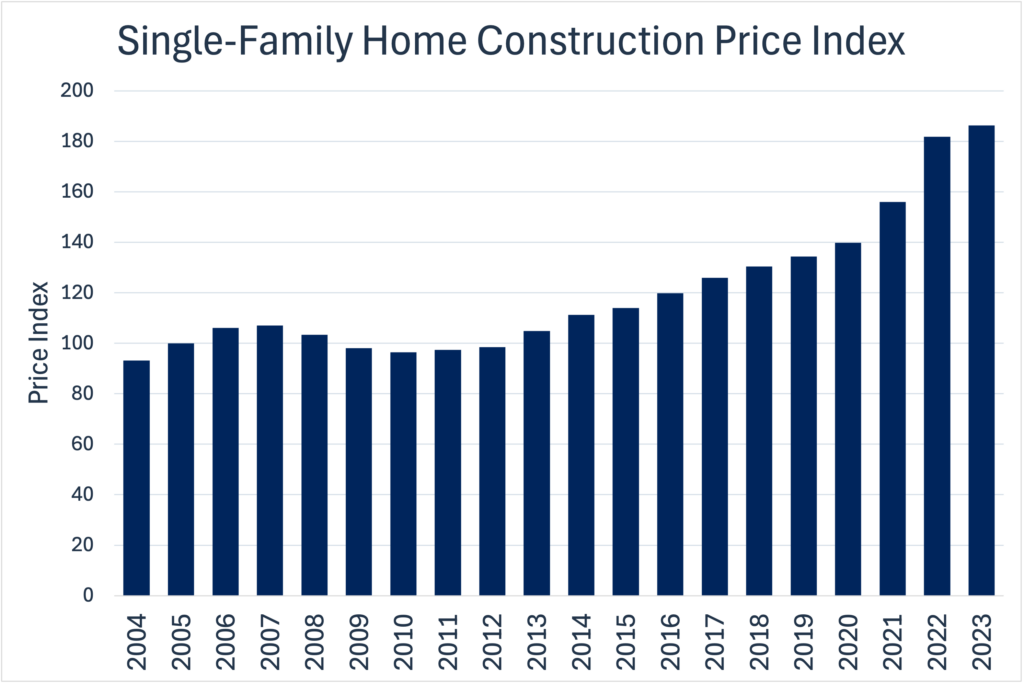

#3: The cost to build a home is increasing

The U.S. Census Bureau tracks an index of the cost to build a new home, which is a good way to estimate and measure the cost of repairs or rebuilding a home after a disaster. Since 2019, the cost to build a new single-family home has increased 40% which translates for higher costs for insurers when they need to pay for repairs.

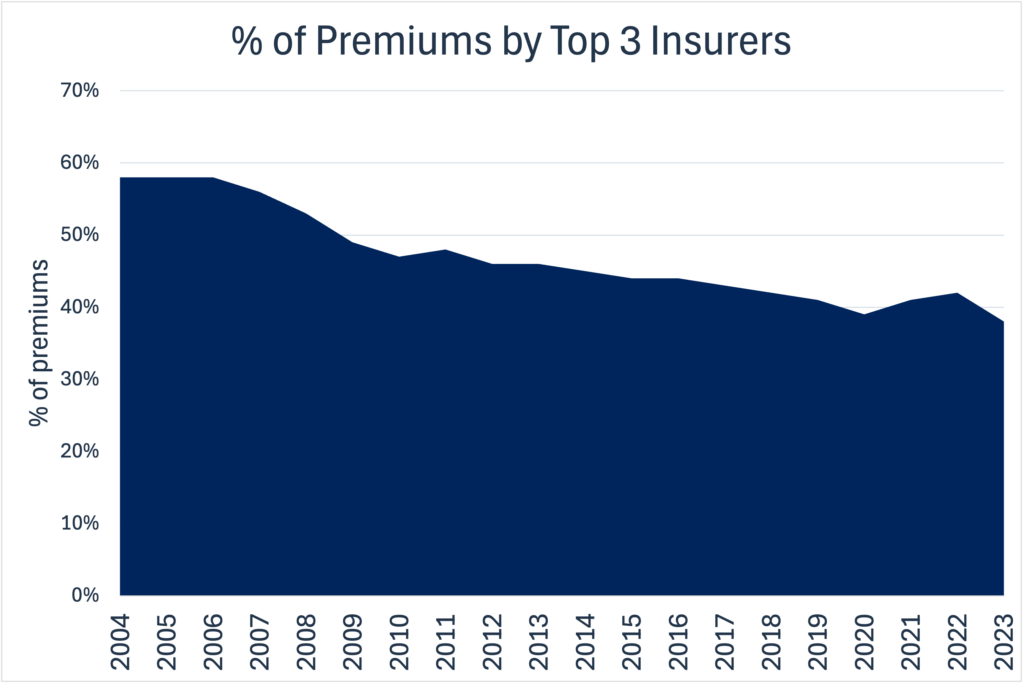

#4: The top insurers are insuring less and less

Over the past 20 years, the market share of the top three insurers in Louisiana—State Farm, Allstate, and Farm Bureau—have significantly decreased. In 2004, these insurers accounted for two-thirds of all premiums. Today, they represent only one-third of the market. This reduction in business by the largest insurers has led to increased reliance on smaller insurance providers.

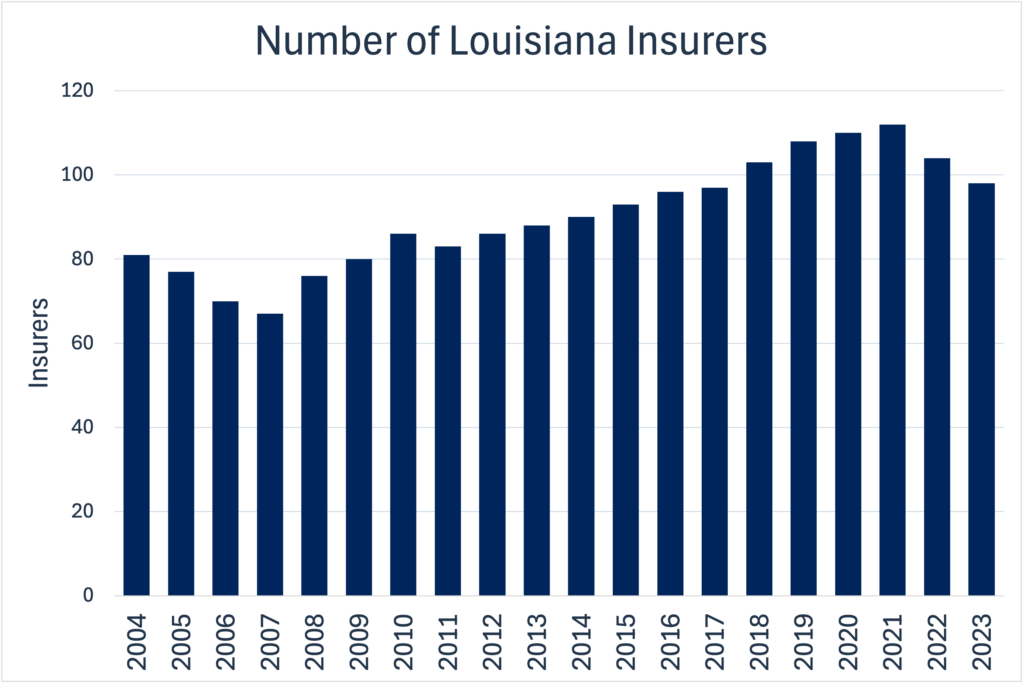

#5: More Louisiana homeowners rely on smaller insurers

As major insurers reduce their presence in Louisiana, more homeowners are turning to smaller, often newer, insurance companies. Insurance companies use multiple entities in the state to issue policies, but based on our estimate the number of unique insurers offering policies in the state increased by 20% from 2004 to 2023, peaking at 112 in 2021.

While this diversification provides homeowners with more options, it also introduces risks:

Smaller insurers are less technically enabled and resources of larger companies, potentially complicating claim processes during major natural disasters.

Smaller insurers may be more susceptible to failure. The Louisiana Insurance Guaranty Association (LIGA) is a private association of insurance companies established by Louisiana law to provide certain benefits to the policyholders and claimants of insolvent insurers. From 2021 to 2023, LIGA handled insolvencies of 10 homeowners insurers. For the five years preceding 2021, these 10 insurers represented the failure of 20 percent of the homeowners insurance market by total premiums earned.

As new legislation recently signed into law by Louisiana Governor Jeff Landry comes into effect, it will be interesting to see if these policies meet the goals of attracting more insurers and making coverage more affordable. Read more about how these changes may impact the claims process.