Insurance claims are all about proof.

The “Proof of Loss” document is the ultimate proof vehicle for insurance claims.

From the moment a claim is filed, all stakeholders come together to understand and document the loss: what caused the loss, the scope of damages, and the cost of losses. For policyholders to get paid, they’ll eventually collect everything and submit it to the insurance company as a “Proof of Loss.” This is a simple document signed by the policyholder under oath identifying the loss and the claim amount.

The “Proof of Loss” process is the same for almost every type of insurance claim under the sun — but because property losses are so complicated and involve intricate proof, the proof of loss for property insurance or homeowners insurance is the most comprehensive of the bunch.

If you’re a policyholder dealing with a property claim or a professional adjuster or contractor helping a policyholder, the claim will eventually come down to the proof of loss process. This article is your ultimate sidekick to understand how to use this form and how to protect your rights.

This article will help you get the proof of loss document right, get paid faster, avoid pitfalls, and protect your rights so that your claim is paid fairly and completely.

What Is The “Proof of Loss?”

A “Proof of Loss” — also referred to as a “Statement of Loss” or a “Sworn Statement in Proof of Loss” — is a formal document required by insurance companies that details the extent of damage, the value of the loss, and supporting evidence. The form is a “sworn statement,” meaning it’s a statement made under oath by the person signing it (i.e., the policyholder). The policyholder signs the statement, and the signature is notarized.

It’s that simple. A formal definition is: “A statement submitted to an insurer setting forth a loss that the insured expects to be covered.”

In the context of a property or homeowners insurance claim, a Proof of Loss may be created to “swear to” losses related to any and all of the “coverages.” This means that the policyholder may be asked to swear to:

- Content Losses: The policyholder will swear to the amount of contents damaged in a loss and its value;

- Additional Living Expenses or Loss of Use: The policyholder will swear to the “additional living expenses” or “losses of use” incurred after a loss.

- Dwelling Losses: The policyholder will swear to the scope and cost of losses to the dwelling, property, and/or additional structures.

During a claim, policyholders may create multiple supplemental proofs of loss forms. In other words, you don’t have to wait to collect everything about a claim before submitting a Proof of Loss document. Policyholders can (and should) submit POLs whenever any portion of their losses is clear because POL submissions put the insurance company on the clock to act and make payment.

The form itself can be complicated, and this post will guide you through POL forms in the below section. Generally speaking, proof of loss documents include the following essential elements, as outlined nicely by Kraph Legal in their POL blog post:

- Amount of Loss: The financial value of the loss incurred (i.e., how much the losses cost)

- Supporting Documentation: Reference and verification for all the supporting documentation submitted to the insurer, including receipts, photos, videos, estimates, reports, and other evidence.

- Date of Loss: The exact date, or an approximation, of when the loss occurred;

- Cause of Loss: Statement as to the policyholder’s understanding of what caused the damages;

- Identifying Info: Identifying the name of the claimant, insured party, property, etc.

The Proof of Loss Form

This process may be intimidating, but at the end of the day, the Proof of Loss Form is just that — a form! The policyholder fills in blanks to provide basic information about the insured property and what is claimed.

This guide will walk you through everything you need to know to confidently complete a proof of loss form.

Which Form To Use?

Many policyholders learn about the “Proof of Loss” requirement when the insurance company sends them a form. Some are nervous about the form’s details, legal language, and notary requirements. They might wonder if they need to use that exact form. Can I trust the insurance company’s form?

The short answer: Policyholders usually don’t need to use the insurance company’s form exactly but do need to submit a “proof of loss” in a “substantially similar” format.

The Proof of Loss requirement comes from the insurance policy itself.

You’ll find the requirement in the policy’s “Duties After Loss” section, which requires policyholders to submit a signed, sworn proof of loss statement that includes specific information about the claim.

In most states, courts do not require policyholders to adhere strictly to a provided form or stick the landing with every minute detail. Instead, policyholders are usually required to “substantially” comply. Here are a few examples:

| Louisiana | It does not need to be formal — a handwritten estimate, personal property inspection by an insurance adjuster, or even allowing the adjuster to inspect when the adjuster fails to do so have all been judged “satisfactory” in Louisiana courts. As stated in Lamar Advertising v. Zurich (2020), “Satisfactory proof of loss is a flexible standard that means the insurer must receive sufficient information to act on the claim.” It remains a best practice to submit a Proof Of Loss form, but the requirements are very flexible in Louisiana. |

| California | Insurance companies can require proof of loss cooperation but cannot deny a claim based on POL documentation unless they are “substantially prejudiced” by a Proof of Loss failure. Practically speaking, policyholders should cooperate to the best of their ability but not feel pressured to use exact form language, add more details to the sworn statement than desired, etc. (Nice explanation in Haffner Law’s “Proof of Loss Trap” article). |

| Florida | The proof of loss requirement is enforceable in Florida but gets favorable treatment to the policyholder. Since the POL requirement is enforceable, policyholders cannot file a lawsuit against their insurance company if they do not cooperate with the POL requirement. However, they can submit the POL late (even right before filing suit). In that case, the insurance company must show they were “prejudiced” by the POL’s failure to avoid the claim. (Great explanation in Rumberger Kirk’s post, “Florida’s Fourth DCA Upholds Sworn Proof of Loss Requirement.“ |

Nearly every state manages Proof of Loss formalities, which is something like this. Insurance companies can ask for proof and usually require sworn proof of loss statements. But, they can’t “trap” a policyholder on technicalities, and policyholders will be given a lot of leeway in the insurance claim process. Generally speaking, if the policyholder remains cooperative, gives the insurance company access to see the damages, and doesn’t neglect the claim process… it will be fine. And, as you’ll see further down in this article, the proof of loss document can be an enormous benefit for policyholders who send POL statements early and often on insurance claims.

In other words: Be not afraid!

You can likely use the insurance company’s form without suffering any consequences, but you are totally able to use your own proof of loss form.

And you should consider your own form because:

- You can add your own protective language (examples below)

- You can avoid signing onto language that may restrict your claim.

- Your form may make filling it in more straightforward (and thus, more accurate)

So, now that you’re not intimidated and afraid of the “Proof of Loss,” let’s get into the form itself and how to fill it out.

Guide To Filling Out The Proof of Loss Form – Form Fields

I dislike the common “Proof of Loss” form that insurance companies provide—and it’s not because they are predatory. It’s not the information requested, or the language used. Frankly, the forms are just ugly and confusing in structure. The entire Proof of Loss process would be much better if the forms had a better user experience.

For example, take a quick look at the 2 forms below, presented side-by-side. The Left Form with the Red Outline is an insurance company-provided document, and the Right Form with the Blue Outline is a ClaimSpot POL Form Template. The Right Form is less intimidating, cleaner, and simpler- yet the same information!

Nevertheless, these proof of loss documents all collect the same information.

Therefore, below is a field-by-field breakdown of the information you’ll need to provide in virtually any Proof of Loss form. To help you better understand the fields, we break them down into categories below: (1) Policy Information, (2) Property & Ownership Information, and (3) Claim Information.

Policy Information Fields

The first category of fields you’ll find on a Proof of Loss document looks to identify the insurance policy in play. These should be extremely easy to fill in. You can get these right off the insurance policy’s declarations page, from the insurance agent, etc. Here are some of the fields you may have to fill in.

| Insurance Company | This is the name of the insurance company that provides coverage to your property. That’s it! This one may feel ridiculous — especially if you got the form from the insurance company. Nevertheless, it’s important to include this information so the document makes sense and applies to the right circumstances. |

| Policy Number | Provide the policy number assigned by your insurance company. This number can usually be found on your insurance policy documents. |

| Coverage Amounts | This is the amount of “insurance coverage” provided to your property. You likely want to separate how much coverage is provided for each coverage category, such as Dwelling, Contents, Other Structures, Additional Living Expenses, or Loss of use. |

| Other Insurance | Do you have more than 1 insurance policy on the property? If so, you need to identify that “other insurance” if the POL asks. If not, just put “none” or “not applicable.” |

Property & Ownership Information Fields

The second category of fields you’ll find on a Proof of Loss document is also quite simple — you’re asked to identify the property in play. Questions like where the property is located, who owns it, who has an interest in it, etc. Here are some fields you’ll encounter and need to fill in within this category.

| Property Address | Provide the full address of the insured property, including street, city, state, and ZIP code. |

| Name of Insured | This is the name of the person(s) or entity(ies) who benefit from the insurance policy. This is usually the property owner(s). It’s possible that the insurance was taken and paid for by a third party (like a mortgage company), or some other circumstances, whereby the “insured” party is not the property owner. However, it’s usually the same. Identify who bought / “owns” the insurance policy here. |

| Property Use | You may be asked to identify how the property is used. Specify the primary use of the insured property (e.g., primary residence, rental property, vacation home, commercial property, etc.). |

| Property Owner(s) | Who owns the property? In this field, you identify each and every owner. |

| Mortgagee(s) | Provide the names of any mortgage holders or lenders with a financial interest in the property. |

| Any “Changes?” | Confirm whether there have been any changes in the property’s interest, use, occupancy, possession, location, or exposure since the insurance policy was issued. If there have been changes, provide details. If there hasn’t been any changes (and this is normal!), then just say “none” or “not applicable.” |

Claim Information Fields

Finally, the third category of Proof of Loss fields will focus on the claim information itself. This is the most important category of fields because this is really what the entire Proof of Loss document is about. These forms ultimately ask you to “swear to” the fact that these losses happened and have these costs. Accordingly, you want to pay close attention to what you put into these fields. Here are some fields you’ll encounter and need to fill in within this category.

| Claim Number | Enter the claim number assigned by your insurance company when you reported the loss. |

| Date of Loss | Provide the date when the loss or damage occurred. If you don’t know the exact date, provide an approximation. |

| Cause of Loss | Describe the cause of the loss or damage. Most proof of loss forms have checkboxes here where you can select the applicable losses. If not, you may want to stick to this language: – Wind – Hail – Flood (note special POL rules for flood insurance) – Water (excluding flood) – Fire – Theft – Earthquake – Land Movement – Freeze – Vandalism |

| Property’s Actual Cash Value | Estimate and enter the actual cash value of the property at the time of the loss. This is the value of the property MINUS depreciation. |

| Losses & Damages | The estimated value of the losses and damages sustained. |

| Claim Amount | Provide the total amount you are claiming for the loss and damages. If the policy is a “replacement cost value” policy (RCV), this will be the total amount to replace all losses and damages. If the policy is an “actual cash value” policy (ACV), the amount claimed will be the depreciated cost to repair or replace the damaged property. (I like this article explaining the difference between ACV & RCV) |

Guide To Favorable & NonFavorable Language In Proof of Loss Forms

The above section details the fields to complete in a Proof of Loss form. These fields identify the property, its policy, and the claim details. However, perhaps the legal language surrounding all the input data is the most important and consequential aspect of these forms.

This Proof of Loss Language can work in the policyholder’s favor or against the policyholder. This section guides this language, specifically identifying what you should include in your document and what you should watch out for.

Favorable POL Language – Include These Provisions

Filling out and submitting a sworn statement in Proof of Loss is a great thing, not a bad thing or scary. As this article explains, these documents put the insurance company on the hot seat and require them to make a fast claim payment. Policyholders should be especially pleased to submit these forms if they contain fair language that protects the full claim.

In other words, policyholders can (and should) add language to the Proof of Loss to properly qualify what the document is saying and what it is not. This will protect the policyholder from “releasing” too much or giving away more claim rights than expected.

And remember — you can use the insurance company’s exact form, but you don’t need to. Even in states with the strictest POL rules, policyholders still only need to comply substantially, and the policyholder can certainly add protective legal provisions into these forms.

Surprisingly, more articles aren’t written using the suggested language. The internet is full to the brim with “Proof of Loss Guides,” How-Tos, “Top Mistakes Made,” and “Best Practices.” It’s astonishing how infrequently these articles suggest adding protective language to the POL docs. Professionals helping policyholders — like attorneys, public adjusters, restoration contractors, accountants, and others — should make this part of their standard recommendations.

Here are some example provisions to include within the Proof of Loss document.

| Type | Example Language |

| Reserve The Right To Supplement | “The undersigned reserves all rights under all policy terms, state laws, federal laws, regulations, and similar provisions to supplement this information” |

| Qualify Your Knowledge & Information | “The undersigned provides this PROOF OF LOSS in good faith, and this information is based on the undersign’s current information, belief, and impressions, all of which continue to evolve as more time passes and more information is acquired, professionals are consulted, inspections are performed, loss areas are exposed, market prices are adjusted, and similar things impact what is known about the cause, scope, and cost of all losses.” |

| Reserve All Rights | “The undersigned reserves all rights to avail himself/herself/itself of all rights and privileges within the policy or applicable laws and regulations.” |

| Assert Expected Insurer Duties | “Insured relies upon and reserves all rights for the INSURANCE COMPANY’S duties of good faith, its duties of investigation, and all duties and obligations under the INSURANCE POLICY and all state and federal laws and regulations.” |

Unfavorable Language – Watch Out For These Provisions

Most insurance companies will present policyholders with fair and balanced proof of loss forms. However, there are circumstances when insurers (or aggressive independent adjusters) provide heavy-handed forms asking policyholders to waive too much.

Policyholders should be mindful of this and ensure they are not signing (and swearing to) more than they expect or need to.

Remember that state laws are very favorable toward policyholders. Policyholders have a lot of leeway to submit “proof” to insurance companies to satisfy the POL request. Therefore, policyholders should feel pressure to sign documents with aggressive language.

Here are some example provisions to include within the Proof of Loss document.

| Type | Example Language |

| Full & Final | Watch out for language stating that the Proof of Loss is the “Full and Final” representation of the claim amount. |

| …Discovered In the Future | Watch out for language stating that the Proof of Loss information represents all the information “known now or discovered in the future.” |

| “Settlement” | Insurance companies should not hijack the “Proof of Loss” form to create a “settlement” of the claim or a “release.” The Proof of Loss document should be kept to its format’s intention — it should just be the policyholder’s sworn statement that the loss occurred and the damages are known to be $x. Reject any language that overreaches to convert the POL into a legal settlement or release agreement. |

Standard Language – Typical (and Okay) Provisions in POL Forms

As you can see, the Sworn Statement in Proof of Loss can pack in a lot of language. There are some provisions that policyholders should question and avoid. Other provisions, however, policyholders should be added to keep their claim in a fair position.

Aside from these “positioning provisions,” POL forms commonly have some language around “fraud” that is pretty standard. Since states give policyholders a lot of leeway, they could refuse to sign these provisions. But, generally speaking, these provisions are worth including because they help the insurance company know that the policyholder is acting “on the level.”

| Type | Example Provision |

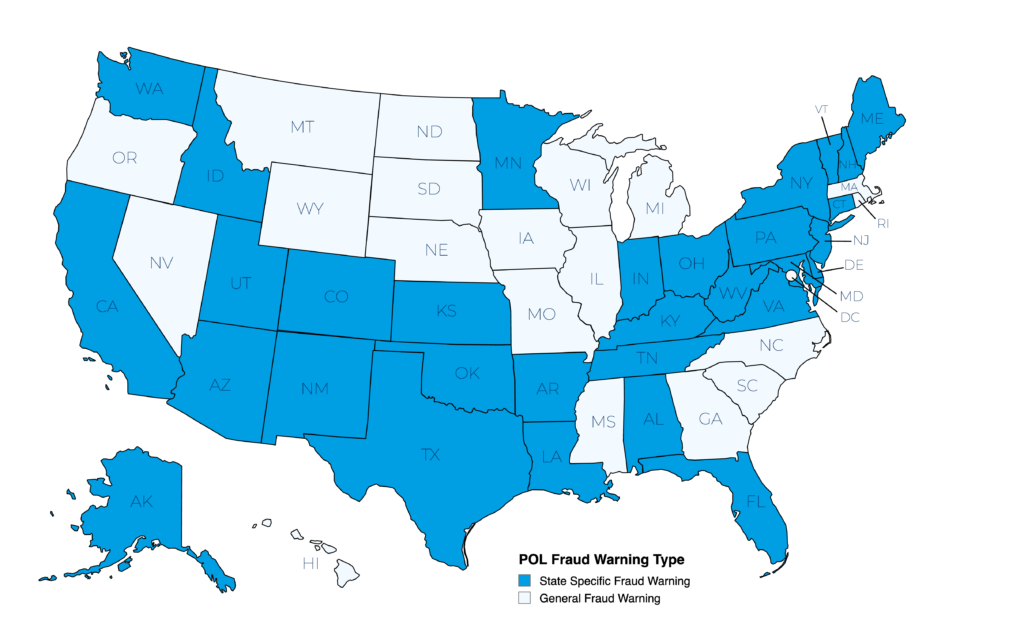

| Fraud Warning | State law often requires “Fraud Warning” provisions. Market Insurance Company has a great compilation of the “Fraud Warnings” required in each state. Here is the Florida example: “Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim containing any false, incomplete, or misleading information is guilty of a felony of the third degree.“ |

| No Fraud Loss Originated | “The said loss did not originate by any act, design, or procurement on the part of your insured or this affiant: nothing has been done by or with the privity or consent of your insured or this affiant to violate the conditions of the policy, or render it void; no articles are mentioned herein or in annexed schedules but such as were destroyed or damaged at the time of said loss; no property saved has in any manner been concealed, and no attempt to deceive the company, as to the extent of said loss, has in any manner been made. Any other information that may be required will be furnished and considered as a part of this proof.” |

Here is a map of which States have specific state-mandated fraud warnings and which do not.

Free Proof of Loss Form

Policyholders — and professionals like contractors and public adjusters — may want to use their own Proof of Loss form. This is a great practice, and for this, the ClaimSpot template is great. The ClaimSpot template has been built by lawyers with experience litigating insurance claims, includes everything most insurance companies require, and includes protective language to best position policyholders in their claims. Plus, it’s free.

Download the Proof of Loss Form for free here.

Here are 4 Reasons To Use the ClaimSpot Proof of Loss Form:

- You Can: You may feel pressure to use the insurance company’s provided form, but case law and statutes are unambiguous. You can use something else…so why not use something you trust will protect you versus the insurance company’s paper?

- Favorable Language Included: The ClaimSpot form includes the favorable language discussed in this article, and you can have confidence it doesn’t include non-favorable or problematic language.

- It’s Easier: The layout of this form is more straightforward to fill out accurately without making mistakes.

- It’s Easily Limited!: This is an important one. The ClaimSpot POL form is designed to be limited. This means you can very clearly check off only a portion of the claim included in the proof of loss.

While the General Proof of Loss form should be enough in most circumstances (after all, the formality is not critical)…each state law does prescribe different “fraud statements.” This is an important part of the form, and it’s a good practice to use a form with the “fraud warning” statement approved by your state.

Therefore, here is a “Proof of Loss Form” for each state.

Some states do not have mandated fraud language, so we simply link to the general POL form for these states.

| Alabama | Hawaii | Massachusetts | New Mexico | South Dakota |

| Alaska | Idaho | Michigan | New York | Tennessee |

| Arizona | Illinois | Minnesota | North Carolina | Texas |

| Arkansas | Indiana | Mississippi | North Dakota | Utah |

| California | Iowa | Missouri | Ohio | Vermont |

| Colorado | Kansas | Montana | Oklahoma | Virginia |

| Connecticut | Kentucky | Nebraska | Oregon | Washington |

| Delaware | Louisiana | Nevada | Pennsylvania | West Virginia |

| Florida | Maine | New Hampshire | Rhode Island | Wisconsin |

| Georgia | Maryland | New Jersey | South Carolina | Wyoming |

Proof of Loss Rules on Federal Flood Claims

Almost all of this article is written with standard property or homeowners insurance claims in mind. These are all regulated by state laws and state insurance commissioners. Everything is different when the National Flood Insurance Program (NFIP) is involved. And if you have a NFIP flood insurance claim, you should consult this separate article: The NFIP Flood Proof of Loss Guide.

The federal government heavily regulates flood insurance through the NFIP, which imposes uniform standards and stringent guidelines to manage flood damage’s widespread and often severe impact. This federal oversight ensures consistency and thoroughness in the claims process, which is essential given the potential scale of flood-related losses.

In contrast, homeowners insurance is regulated at the state level, resulting in varied requirements and greater flexibility. Each state has its own set of rules and regulations, reflecting local considerations and legal standards. Additionally, private insurers offering homeowners insurance can set their own procedures within state law, allowing for more customization and adaptability in the Proof of Loss process.

In other words, if you’re making a flood claim, pay particular attention to this section, which will outline the key differences in Proof of Loss requirements.

- POL Submission is Required: Unlike standard property, fire, and homeowners policies regulated by a patchwork of state laws, the federal flood insurance policies require a Proof of Loss submission. This is strictly enforced, and claims will be denied if a POL is not submitted. Get FEMA’s Free Proof of Loss Form document here.

- POL Must Be Submitted Within 60 Days Without Request: The standard NFIP Policy requires policyholders to send proof of loss “within 60 days after the loss.” This is much different from standard property, fire, and homeowners policies, which usually require POL submissions after the insurance company requests them. With flood losses, the policyholder must submit POLs within 60 days of loss, whether requested or not.

The 5 Proof of Loss Best Practices To Dominate Your Claim

The Internet will provide a lot of Proof of Loss advice. But, honestly, it’s surprising how much of this “content” isn’t very helpful and just mashes up together to look the same. Here, I’ve worked to collate the best advice from some of the best, most expert authors, but also to provide policyholders (and professionals) some very actionable POL best practices that put them in the Proof or Loss drivers seat.

After all, the Proof of Loss Form Should Be The Policyholder’s Best Friend! Policyholders shouldn’t be shy about this document, but instead, should embrace it. This is the perfect way to deliver claim information to the insurance company as it puts the insurance company on the clock to make payment, and triggers very important duties favorable to policyholders.

These 5 Best Practices Tips will give policyholders confidence when submitting these forms, and will show them how to use these documents early and often to get insurance claims paid faster.

1: Send POLs Early and Before The Insurance Company Starts Asking

Everyone waits way too long to start talking about and using Proof of Loss forms. Policyholders should use these forms as soon as possible after filing a claim.

Policyholders (and professionals helping them like attorneys, public adjusters, and restoration contractors) start communicating with the insurance company right after filing a claim. They start sending photographs, estimates, and other evidence. So, why not prepare all of this information along with “sworn statements” that will more clearly constitute a “proof of loss,” and therefore, trigger the state laws that are super favorable to policyholders?!

Noting prevents policyholders from doing this, and I contend it’s a very underused best practice.

Policyholders who follow this best practice will watch their claim timelines plummet and claims get paid much, much faster.

Why? What “favorable state laws” am I referring to here? Take a look at some example rules…

| In Louisiana… | The insurance company MUST PAY undisputed claim amounts within 30-days from receipt of a “satisfactory proof of loss.” While you can argue about “what constitutes satisfactory proof of loss” until the cows come home (see full article above), sending a sworn proof of loss will go a long way to put the insurance company on the hot seat….and get that critical 30-day clock ticking. |

| In Texas… | In Texas, insurance companies must “accept or reject” a claim within 15 days from when they “receive all required documentation.” Unlike Louisiana, these TX statutes do not explicitly refer to the “proof of loss,” but insurance companies will almost always claim the POL is part of the “required documentation.” Therefore, send that POL early…it will get that 15-day clock ticking. |

Every state’s law is slightly different, but also generally the same: Sending a Proof of Loss will trigger a clock for the insurance company to accept, reject, and pay the claim. Therefore, instead of sending all those photos, estimates, and proof items via email and text…package it all together, submit a Proof of Loss instead.

Don’t wait for the insurance company to request it. Send it on your terms.

You may ask: What if I don’t have everything together? What if I don’t have all the proof?

That’s okay. Because the #2 Best Practice is to send a POL often…

2: Send POLs Often and As You Collect “Proof”

Treating POL Documents as the “last step of an insurance claim” is a mistake. As stated in this article’s very first line, “Insurance claims are all about proof.” There’s absolutely no reason to wait until the bitter end of the claims process to prepare and submit “sworn statements” about the proof that is constantly prepared during an insurance claim. Instead, consider preparing and submitting proof as sworn statements all along the way.

Keep the following in mind to do this successfully.

- Always Qualify That You Can Supplement: Always include the favorable language suggested earlier in this article whereby you “reserve the right to supplement” the proof of loss.

- Indicate What The Proof of Loss Is For: It’s also helpful to indicate on the “sworn statement” what exactly the statement relates to. Are you delivering “proof” of your contents losses, or just for emergency repairs? Then specify that.

Think about it like this. Right after a property loss you may need to make “emergency repairs.” You’ll deliver “proof” of those emergency repairs to the insurance company. Instead of an email with your receipts, send a specific proof of loss document for it. Say it’s for the emergency repairs, and reserve your right to supplement it.

Take a look above at how the Free ClaimSpot Proof of Loss Form lets you select the specific coverage(s) for which the “sworn statement” is submitted.

It’s that simple, and it’ll work wonders!

3: Send With Cover Letter That Makes Expectations Clear

Sending your proof with a “sworn statement” is a power move. Make your expectations clear with a well-drafted cover letter informing the insurance company that you’re delivering sworn proof to them, meeting policy duties, and triggering statutory deadlines that you expect the insurance company to follow.

This will cause the insurance company to put your proof on the top of the pile and pressure them to reply quickly and concretely. If they don’t “accept” the proof or process the claim for payment, you’ll have a much better position against the insurance company.

4: Track Delivery to the Insurance Company Closely

This one should be pretty obvious — but in the chaos of insurance claim correspondence, a little email here or text there can get lost in the pile. The cleaner policyholders are in sending and tracking communications…the better, faster, fairer, and more completely the insurance claim will get handled.

This is especially the case with formal, deadline-triggering correspondence and deliveries…like the Proof of Loss.

Therefore, be mindful when sending this document. Send it through multiple channels (i.e. email and physical mail). Keep track of delivery by sending it through a channel that has delivery confirmation. Ask for confirmation in writing from the recipient. Etc.

Whatever you do, keep track of the sending and track/confirm the delivery.

5: Set Your Followup Timeline and Prepare To Send A Default Letter

If you follow these best practices, most policyholders will get a timely follow-up and response. But if not, be prepared to follow up yourself.

When you send this document, the insurance company is “on the clock.” They have very explicit duties. As soon as you send your Proof of Loss document, you should mark your calendar with the number of days the insurance company has to reply to it.

What is a “reply?” Most states require payment or a clear approve/deny statement from the insurance company after policyholders deliver proof, especially after delivering “sworn proof.”

Here’s a list of some state-required timeframes that insurance companies must reply to delivered “Proof.”

| State | How Company Must Reply | Days Until Reply Due | After Receipt Of The… |

| California | Payment | 60 Days | “proof of loss” |

| Florida | Payment | 60 Days | “Initial notice of the claim” |

| Louisiana | Payment | 30 Days | “Satisfactory Proof of Loss” |

| New York | Accept or Reject Claim | 15 Days | “Completed Documents” |

| Texas | Accept or Reject Claim | 15 Days | “Required Documentation” |

Keep a close eye on the date you can expect a response, and if you don’t get the reply, follow up with a strongly worded (and delivery-tracked!) letter reminding the insurance company of your expectations and noting that you avail yourself of all state bad faith protections.

Proof of Loss Frequently Asked Questions

Navigating the Proof of Loss process can be complex and daunting for many policyholders. To help you better understand and manage this critical step in your insurance claim, we’ve compiled a list of the most frequently asked questions about Proof of Loss forms. This section addresses common concerns, provides clear and concise answers, and guides you through the intricacies of submitting a Proof of Loss. Whether you’re a first-time claimant or looking to refine your knowledge, these FAQs will equip you with the essential information to ensure your claim is processed smoothly and efficiently.

Submitting a Proof of Loss form is a requirement by most insurance policies. It ensures your claim is documented officially, triggers the insurer’s duty to process it, and helps you receive timely compensation.

You should submit your Proof of Loss form as soon as possible after a loss occurs and within the timeframe specified by your insurance policy, typically 60 days from the insurer’s request. Importantly, on flood claims, which are insured pursuant to the National Flood Insurance Program, the insured must submit the POL “within 60 days after the loss.” This is a very strict requirement, and policyholders must follow it.

Yes. You can and should submit multiple Proof of Loss forms as new information becomes available. This ensures that the insurer documents all aspects of your loss and processes it promptly.

Failing to submit a Proof of Loss form can delay or deny your claim. It is a crucial part of the claims process, and neglecting this requirement may impede your ability to receive compensation.

Yes, you can use the form provided by your insurance company. However, you can also use a customized form that includes favorable language and protects your rights. Ensure it is substantially similar to the insurer’s form and includes all necessary information. Take a look at the free ClaimSpot template provided above.

Property is commonly owned by multiple people or entities, meaning a single insurance policy may name multiple insured parties (i.e., multiple policyholders). Generally speaking, one person can submit the sworn proof of loss. Case law consistently allows for 1 proof of loss signor to benefit all the other insured parties. See, for example, Porta v. Hartford Fire Insurance Company (New York), saying, “Where insurance is procured by several owners [or partners], a proof of loss may be presented by any one of them to the benefit of all.”

Policyholders want to send their proof of loss to the right place because they want deadline clocks to start ticking against the insurer. It’s common to be swamped with “contacts,” “agents,” and “representatives” during the claim process…so who to send it to? And where? Generally speaking, you can submit the POL to an agent or officer of the insurance company, and you can likely rely on an agent’s “apparent authority” to accept the document.

After submitting a POL, the insurance company must approve or reject the claim represented in the statement. The insurance company cannot “reject” a proof of loss because it disagrees with the claim(s). It can only reject a POL for technical reasons, such as a missing signature. Once policyholders submit the document, they can assume it was adequate unless the insurance company rejects it for an identified technical reason (see, for example, John Hancock Mutual Life Ins. Co. v. Highley, an Oklahoma case). Suppose the insurance company does reject a document for some technical reason. In that case, most state courts require it to identify that reason and give the policyholder a reasonable amount of time to correct the defect.

While the insurance company cannot “reject” the POL because of claim disagreements, it can “deny” the claim. In this case, the POL is “sufficient” and acceptable, but the claim itself is disputed and now escalates into litigation or some other disputed state.

Once you submit your Proof of Loss, the insurance company is “on the clock” to process it and make a claim decision about the proof. Here are some things that might happen after submission:

1. They “reject” the POL for technical reasons.

You can learn more about this in the previous question (“Can An Insurance Company Reject My Proof of Loss?”). This is uncommon, but the insurance company may “reject” your submission for technical reasons and ask you to resubmit. If that happens, review the highlighted problems, correct them, and resubmit.

2. They can “deny” your claim

This is unfortunate, but insurance companies may review your POL statement and materials and deny your claim. You will likely be formally notified of the denial in writing by mail. There are many reasons why a claim could be denied, and the written “deny” notification should outline some reason(s) for the company’s decision. If your claim is denied, you can decide whether to escalate your claim through legal action.

3. They can “approve” your claim

The happy case is that the insurance company receives the POL and “approves” the claim, placing it in line for payment. This is as straightforward as it sounds. If the POL was for the full claim amount, that is the end of your claims journey. If the POL was for a portion of the claim, you still have more claims to work on.

4. Settlement Offer / Negotiation

Finally, the insurance company may “approve” aspects of the claim but offer different amounts to you because of cost or scope disagreements. You may feel like the offered amounts are too low, especially if you have contractors and/or estimates indicating other amounts. You can negotiate with the insurance company, hire a professional, and/or proceed into litigation to enforce your claim rights.

How Professionals Can Help Policyholders with Proof of Loss Forms

Public adjusters, attorneys, and restoration contractors play crucial roles in helping policyholders navigate the Proof of Loss process. These professionals can provide expertise in accurately estimating damages, ensuring all necessary documentation is included, and negotiating with insurance companies. However, each professional must also navigate regulatory hurdles. Here are some key ways professionals can assist and regulatory traps to avoid.

Examples of How Professionals Can Assist

Professionals like public adjusters, attorneys, and restoration contractors can leverage their experience to help policyholders avoid common Proof of Loss pitfalls. Perhaps more importantly, professionals give policyholders the proof they need to submit the document. Here are some examples of how professionals can help:

- Assess & Document Damage: Restoration Contractors and Public Adjusters can greatly help policyholders by assessing and documenting the damages. After all, these assessment and estimating services are the very essence of what these professionals do. This is important information that will support the entire Proof of Loss statement.

- Help Deliver POL Professionally: All professionals (adjusters, contractors, attorneys, and others) can help policyholders deliver their POL statement professionally and with appropriate tracking. Unlike the policyholder, these professionals have a lot more experience communicating with insurance companies, and it would be helpful to policyholders to package and deliver the POL statement.

- Preparing the POL Form: This is a tricky one! Attorneys can definitely (and should) help policyholders fill in and prepare their POL documents. However, restoration contractors and public adjusters need to be more cautious. They could run into Unauthorized Practice of Law issues as per the below.

- Provide Policyholders with Helpful Information: Educating the policyholder is the #1 thing you can do as a professional to help them with the sworn statement in the proof of loss process. Turn them onto this article or others to empower them with information on making the Proof of Loss work for them.

Beware of Regulatory Hurdles

Professionals need to be cautious about violating regulations when helping policyholders. Insurance claims are extremely regulated and there are a ton of heavy-handed protective laws in place to protect certain industries, like the legal industry. Here are the two most common regulatory problems you may encounter as a professional helping policyholders with Proof of Loss documents.

- Unauthorized Practice of Law: Restoration Contractors and Public Adjusters must be mindful not to help policyholders in a way that turns into the “unauthorized practice of law” (UPL). Giving policyholders “legal advice” is UPL, and giving “legal advice” is very easy when helping with insurance claims. Be very cautious about explaining what policy provisions may mean and what someone should do, and help fill out legal documents (is Proof of Loss a “legal document?!” What a can of worms!).

- Unauthorized Practice of Public Adjusting (UPPA): The legal industry isn’t the only folks in town with lobbies. Public adjusters have their own set of regulatory protections, too. While attorneys don’t need to worry about anything (neither UPL or UPAA), and public adjusters don’t have to worry about UPAA, it’s the restoration contractors painted into a corner who must tip toe around UPL and UPAA.

Conclusion

Navigating the Proof of Loss process can seem daunting, but it is critical to ensure your insurance claim is processed accurately and efficiently. Policyholders can streamline their claims process and maximize their settlement by understanding the form’s requirements, proactively managing deadlines, and leveraging professional assistance when necessary.

Remember, the Proof of Loss form is not just a bureaucratic requirement—it is your opportunity to communicate the extent of your loss and demonstrate your commitment to a fair and timely resolution.

Use this guide’s tips and best practices to manage your claim and protect your rights confidently.