Insurance companies are excellent at managing insurance claims. Immediately after receiving a claim, the insurer leverages software, services, consultants, and team members to prepare a robust and detailed claim file. And that file is mostly hidden from the policyholder and all the stakeholders who help the policyholder.

This is an extraordinarily frustrating reality.

The insurance company should be working for the policyholder to adjust the claim quickly, fully, and fairly; but it doesn’t work this way. The insurance company builds its robust claim file for its own benefit.

In a perfect world, all stakeholders would collaborate on the claim file.

But today, you must settle for the second-best option: getting access to the claim file.

The claim file or claim log contains a ton of valuable information to policyholders…and policyholders have a right to see and use almost all of it! This article advocates for more transparent insurance claim files, but while we all hold our breath, it explains why the files are important, how to request them, and how to use them.

What Is The Claim File

Immediately after someone files a homeowners or property insurance claim, the insurance company assigns a claim number, and a “claim file” is opened. As eloquently described by attorneys at Morris Duffy, claim files are the “hard-drive of an insurance carrier.”

More specifically, every shred of documentation and every single interaction on the claim is recorded and logged by the insurance company in their claim file. This will include policy information, witness interviews, photographs, logs of site visits, notes from consultants and adjusters, construction estimates, and more. Literally…everything.

Insurance companies are extremely good at maintaining their claim files. There is an entire industry of software products sold to insurance companies and their consultants to manage the claims file, including products like XactAnalysis and ClaimsConnect.

The insurance company will employ a lot of contractors and consultants on a claim. Sometimes, the entire claims process isn’t actually managed by the insurance company at all. Instead, it’s delegated entirely to a “third party administrator,” which is a company employed to manage the claim from start to finish. And all along the way, there are many types of consultants and contractors leveraged to evaluate a claim.

And everyone who does anything on a claim for an insurance company is required to use their claim managing tools, and the insurer will get very specific about how employees and consultants add to the claim file.

For example, insurance adjusters and consultants don’t just go into the claim file and come up with unique notes. They most often select notes from a picker — these are called “SFLEs” or “Standard File Log Entries.” Whenever you receive a letter from the insurance company, the letter is generated through the software based on very strict state-by-state templates.

The insurance company is very, very sophisticated in how they are preparing your claim file.

So everyone connected to your claim is building a claim file.

It contains a lot of information about your claim.

It is the basis of the insurer’s evaluation.

And very close attention is paid to every single detail.

Can you see it?!!?!

Why Claim Files Should Be More Transparent

The short answer is: yes, you can likely see your claim file.

The claim file is super valuable. And, while every stakeholder helping the insurance company collaborates together on the claim file, it’s simultaneously hidden from the policyholders and all the stakeholders helping them.

But it’s mostly not secret.

Before the 1980s courts mostly considered insurance claim files to be “privileged” material that they could keep secret and hidden from policyholders. But since then, many courts have generally agreed that claim files are not privileged.

In a tidemark case from New York, Landmark Ins v. Rivage Rest, the court distinguished between claim file materials prepared “in the regular course of business to [evaluate the claim]” and materials prepared after a decision to disclaim coverage that is made in preparation for “anticipated litigation.” Only the materials prepared for litigation is “privileged.” (See more recently Cadaret Grant & Co v. Great Am. Ins. Co).

And the evaluation is similar everywhere, like Florida, Kansas, Iowa, South Dakota, Nebraska, Missouri, Texas, etc.

All state courts balance the same consideration: what parts of the “claim file” are privileged and which are not? And each state takes a slightly different position

Some states – probably fed up with the “claim file” gamesmanship – are starting to go further and are passing laws to specifically entitle policyholders to access the claims file.

Consider Louisiana’s 2023 change to the state’s “Policyholder Bill of Rights” to “require an insurer to provide an insured with” certain records within the claims file. The new law specifically requires:

[P]olicyholders shall have the right to request and receive from the insurance company any portion of the claim file, including but not limited to any written reports, estimates, bids, plans, measurements, drawings, engineer reports, contractor reports, statements, photographs, video recordings, or any other documents or communications unless the record that the insurance company prepared or used during its adjustment of the policyholder’s claim is legally privileged in accordance with R.S. 22:1964(14).

LA R.S. 22:41(14).

In other words, the claim file is not a secret by rule. Quite the opposite.

So, why isn’t it shared with the policyholder in real time?

If every insurance consultant under the sun can collaborate on the insurance claim, why can’t the policyholders’ contractors and consultants?

Claim files are definitely a treasure trove of information for policyholders and their consultants. And I would certainly advocate that if policyholders and carriers had access to the same information — at the same time — they could all better understand the claim status, address discrepancies, and stay on the level with one another.

In other words, transparent claim files would foster trust between all the stakeholders, and trust is good.

And since the claim file is not secret, what’s the damn hold up?!

Well, don’t expect transparent, live, shared claim files anytime soon.

But there is still good news. These files are not secret. They are yours to see. You just have to request them.

How To Request Your Insurance Claim File

Can you just request the claims file? Will the insurance company give it to you?

It’s clear that policyholders can get the claims file during litigation by requesting it in “discovery.” As above discussed, virtually all courts will require insurers to produce their claims file.

And if you hired an attorney, the attorney will certainly request the claim file in their first letter of representation to the insurance carrier.

But do you really need a lawyer or a lawsuit to just request the documents?

No, you don’t. You can request them. And you should.

You Can Request The Claim File Yourself (and should)

The policyholder can request the claim file. It’s not rocket science and it doesn’t require a formal seal, notarization, permission, or anything special at all.

Just write a letter and request it.

There are some tips to keep in mind (i.e. do it in writing and not just a request by phone, make sure your letter is specific enough, cite laws if you can, send the document to the right place, and keep a great record of sending/receiving). We can help you with this.

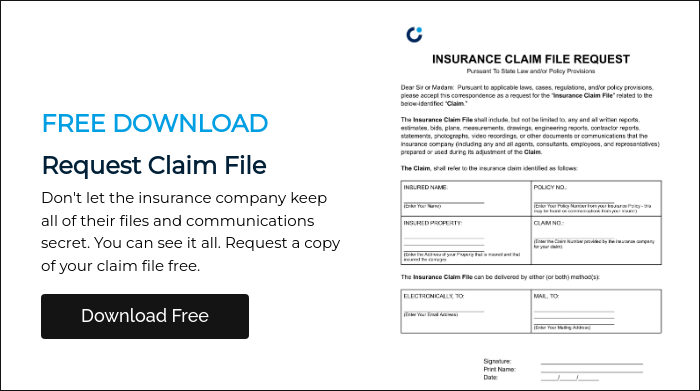

You can use our “Request for Claim File” letter template — or even better, use ClaimSpot’s tool to generate and send your request.

You Should Request The Claim File (and do it often)

Policyholders should definitely, definitely, definitely request their claim files.

If the insurance company complies (and they should) you will get valuable information about your claim, and the insurance company will take notice that you are you pursuing your claim in earnest.

But, there is great value even if the insurance company rejects your request because it will improve your argument that the insurance company acted in bad faith. This is especially the case in states like Louisiana where the insurance company’s failure to comply breaches your “bill of rights.”

So, you don’t need a lawyer to request your claim file, and you should request your claim file.

In fact, you should request it often.

Insurance claims are moving and changing constantly, and this means that the claim file is constantly growing. Policyholders would be well served to request the claim file over and over again as the file grows. Literally, it is a good practice to set up a workflow to make the request every two weeks or every month.

Not only will this keep your information current and help you with your claim, but it’ll keep the insurance company on their toes and working on your claim…which is good. Because you want your claim adjusted and paid fairly and fast.

Why Policyholders Should Keep Their Own Claim File

This article dug deeply on the insurance company’s claim file. A lot of information and materials goes into their claim file, and yes, you should have access to it. But it’s very important to point out something else here — YOU should have a claim file.

Just like the insurance company, the policyholder is also creating and managing a claim file. You are making observations about your loss, incurring costs, getting estimates, taking photos, documenting things, having conversations, etc., etc. You’re at an extreme disadvantage if the insurance company is logging and organizing every little thing while you are piling things up on the coffee table or some Desktop Folder.

You need your own claim file!

And like the insurance company, you should be as structured as possible.

So go off — request the insurance claim files early and often; and be sure to keep your own file, too.