Most flood insurance is provided under the National Flood Insurance Program, or NFIP, operated by FEMA. Unlike all other types of insurance, which are subject to a complex matrix of state laws, federal laws regulate the NFIP.

Policyholders and professionals, like adjusters, contractors, and attorneys, will encounter many differences when a claim is filed under these policies.

The NFIP Flood Proof of Loss Form and Requirements present significant differences that can impact the claim.

Our Ultimate Proof of Loss Guide reviewed the POL process for all other property insurance claims. Confusingly, this guide also applies to “private flood insurance” that is not written under the NFIP (more on that below).

This guide walks policyholders through the POL requirements on NFIP flood insurance claims, which comprise the vast majority of flood insurance. It helps policyholders prepare accurate proof of loss documents and get claims paid faster.

Important: Do You Have An NFIP Policy or Private Flood Insurance (PFI)?

Proof of Loss laws and requirements vary depending on whether you have a National Flood Insurance Program (NFIP) or a Private Flood Insurance (PFI) Policy.

NFIP policies are federally regulated and have stringent POL rules. PFI policies are state-regulated and have liberal POL rules.

This article discusses the NFIP Proof of Loss form, rules, and process, and so should be consulted by those with NFIP policies. Policyholders with PFI policies (or non-flood policies, like standard homeowners insurance) should consult our Ultimate Proof of Loss Guide.

Therefore, policyholders with flood insurance claims must know whether their flood policy is national or private to submit their flood proof of loss successfully.

NFIP Policies: Vast Majority Of Flood Policies

Most flood insurance policies are written under the National Flood Insurance Program, administered by the Federal Emergency Management Agency (FEMA).

Since NFIP “partners with ~50 Insurance Companies and thousands of independent agents” across the United States, it may seem like you have flood insurance privately with companies like Allstate, Homesite, or Wright National Flood Insurance Company. However, while these companies and brands sell flood insurance to you, the insurance itself is still underwritten and administered by the NFIP.

Simply put, your flood insurance is likely part of the NFIP.

Here’s a table of private insurance companies that sell NFIP policies (taken from FEMA’s FloodSmart.Gov Site).

These companies sell NFIP policies under the Write Your Own (WYO) Program, established in 1983 to let private insurance companies help FEMA write and service flood policies.

The WYO Program is very prevalent in today’s insurance markets. So, it’s highly likely you bought a flood policy from one of these private insurance companies (or agents).

In this case, you still has an NFIP policy, the NFIP still underwrites the policy, and the NFIP still pays the claim. Policies issued under the WYO Program by private companies are the same as policies issued directly by NFIP.

If your flood insurance policy is with any of these companies, it’s an NFIP policy, not a PFI policy.

| Allied Trust | Baldwin Mutual Ins. Co. Inc. | First Ins. Co. of Hawaii | NGM Insurance Co. | Southern Farm Bureau Casualty Ins. Co. |

| Allstate* | First Community Ins. Co. | First Protective Ins. Company / Frontline | Pacific Indemnity Co. | Union Mutual Fire Ins. Co. |

| Assurant* | Centauri Specialty Ins. Co | Florida Family Insurance Co. | People’s Trust Ins. Co. | United Surety & Indemnity Co. |

| American Commerce Ins Co | Coastal American Insurance Co. | Hartford Fire Insurance Co.* | Philadelphia Contributionship | Universal Ins. Co. |

| American Family Mutual Insurance | Concord Group Insurance | Homesite Insurance Co | Philadelphia Indemnity Ins. Co. | Universal North America Ins. Co. |

| American Nat. Prop. & Casualty | Cooperativa de Seguros Multiples de Puerto Rico | Island Insurance Co | Pilgrim Insurance Co. | USAA General Indemnity Co. |

| American Strategic Ins. Corp. | CSAA Insurance Exchange | Liberty Mutual Fire Ins Co | Privilege Underwriters | Windsor Mt. Joy Mutual Ins. Co. |

| American Traditions Ins. Co. | Cypress Property & Casualty Ins. Co. | Monarch National Ins. Co. | QBE Insurance Corp. | Wright National Flood Ins. Co.* |

| Auto Club South Insurance Co. | Farm Family Casualty | National General Ins. Co. | SafePoint Ins. Co. | |

| Auto Owners Insurance Co. | Farmers Insurance Group | NFIP Direct Servicing Agent | Selective Ins. Co. of America |

Most flood insurance is provided under the NFIP program.

Until just a few years ago, this was the only way to get flood insurance. New regulations between 2012 and 2019 opened the door for private markets to directly engage in the flood insurance market, creating a new category of flood insurance policies called “Private Flood Insurance.”

PFI Policies: New and Less Common Flood Insurance

Until 2019, virtually all flood insurance was written under the National Flood Insurance Program. After this time, some laws changed, opening up a private flood insurance market. Buying “private” flood insurance entirely outside the NFIP is possible and more common.

Private flood insurance policies are almost identical to NFIP policies. They both protect policyholders against flood losses, although PFI allow (i) higher coverage limits; and (ii) extra coverages, like loss of use.

The biggest difference is in the details: in the event of a loss, claims will be paid off by a private company instead of the federal government.

Because of this, private flood insurance claims are not governed by federal laws. Just like standard property and commercial insurance policies, the claims experience and Proof of Loss requirements are governed by the states.

If your flood insurance policy is with any of these companies, it’s likely a Private Flood Insurance policy, and not an NFIP policy.

| AIG | Berkshire Hathaway | Palomar |

| Allstate* | Chubb | Swiss Re |

| Aon Edge | Kin | Wright Flood* |

| Arch | Liberty Mutual* | Zurich |

| Assurant* | Mapfre | |

| AXA | Neptune |

Checklist To Determine If You Have An NFIP or PFI Policy

The NFIP and PFI distinction can be subtle and confusing. Policygenius has written a helpful article discussing the NFIP v PFI differences in more detail, and that guide is worth consulting.

Here is a quick cheatsheet of questions to help you determine whether your flood insurance policy is an NFIP policy subjected to federal laws (and strict Proof of Loss rules), or a PFI policy subject to state laws (and liberal Proof of Loss rules).

- Do you have more than $250,000 in Dwelling Coverage? The NFIP maximum coverage is $250,000. Therefore, you have a private flood insurance (PFI) policy if you have more than $250,000 in flood insurance coverage.

- Do you have more than $100,000 in Contents Coverage? The NFIP maximum coverage for contents is $100,000. Therefore, if you have more than $100,000 in contents flood coverage, you have a private flood insurance (PFI) policy.

- Do you have “loss of use” coverage at all? “Loss of use” coverage is not available on NFIP policies. Therefore, you have a private flood insurance policy if you have “loss of use” coverage on your flood policy.

If you have a “Private Flood Insurance” policy, you can ignore this guide and follow the Ultimate Proof of Loss Guide requirements.

If you have an NFIP policy, then read on. This is your flood claim guide to the critical “Proof of Loss” form and process.

The NFIP STRICT Proof of Loss Rules

The “Proof of Loss” is critical in NFIP claims. All NFIP flood policies clearly state that policyholders must submit a “proof of loss,” and this requirement is strictly enforced. You can very well expect your flood claim to be denied if you miss the POL deadline, if your proof of loss is not prepared correctly, and/or if you submit it to the wrong place!

There is good news.

The flood insurance policies are super clear about proof of loss requirements, forms are provided, the process is very simple and organized, and with a little help policyholders can get this done right and have their claims processed quickly.

FEMA does a great job of providing clear, organized information to policyholders. Here are key materials that will help:

- Flood Policy Terms: Every NFIP flood insurance policy is the same. Here are the policy documents: (1) Dwelling (for homes); (2) General Property Form (for non-home property); (3) Residential Condo Building Association Form (for Condo buildings).

- Claims Handbook: FEMA publishes a helpful “flood insurance claims handbook” guiding policyholders through the flood claims process.

- Proof of Loss Form: The FEMA Proof of Loss form itself is published by FEMA. You don’t need to use this exact form, but it’s a best practice to provide this federally published form.

- This guide will help you get the Proof of Loss form right. Here we go!

You Must Deliver POL within 60-Days From The Loss

The first thing to know is that the flood insurance Proof of Loss Deadline is very strictly enforced.

You’ll find the deadline in the policy’s Part “VII. General Conditions” and Section “G. Requirements in Case of Loss,” Paragraph 4, providing “Within 60 days after the loss, send us a proof of loss…”

FEMA’s updated insurance claims handbook doesn’t address the 60-day timeline directly, but an older version of the handbook (2014 version) is much more direct, saying: “Your claim for damages must be supported by a Proof of Loss containing the information required by your flood insurance policy. This must be fully completed and signed and in the hands of your insurance company within 60 days after the loss occurs along with your supporting documentation.“

So not only must policyholders accurately complete and send the Flood Proof of Loss within the 60-day deadline…the POL must be delivered within the deadline.

While homeowners, other property insurance, and even private flood insurance all have more proof of loss wiggle room, the NFIP proof of loss deadline is a bright-line rule, and policyholders should follow it to the letter. I love how Merlin Law Group’s Corey Harris describes this in Proofs of Loss and the Standard Flood Policy:

Most [claim] topics…have a myriad of exceptions which might provide coverage even if the terms of the policy have not been completely complied with. While these possibilities do exist in many homeowners policies, the one place you can count on a mistake serving as a basis for denying your claim is when you are dealing with s National Flood Insurance Policy. The requirements of the Standard Flood Policy are pretty clear and failing to follow them to the letter can be devastating.

The only exception to the 60-day requirement is when FEMA specifically extends the deadline through an emergency or disaster declaration. FEMA sometimes issues extensions to the Proof of Loss deadline in disaster conditions.

It’s not easy for policyholders to figure out if an extension applies to them. Extensions are usually restricted to geographies and issued via “bulletins” that rely on local news stations to broadcast and explain. The best practice is to get the POL completed and delivered within 60 days.

Field-By-Field Review: The Required Proof of Loss Form Fields

It’s a best practice to use the FEMA Provided Proof of Loss Form. FEMA publishes this form, and it is de facto sufficient for a successful claim. It’s also pretty straightforward and easy to complete.

| Submission | This field appears at the very top left of FEMA’s Proof of Loss form. You will select one of 2 options from the dropdown. If this is the first POL submitted to your claim, choose “Initial Proof of Loss.” If this is an amended or supplemental submission, choose “Amended Proof of Loss.” |

| Policyholder | This is likely your name. Put the name of the person(s) or entity(ies) who purchased the policy. |

| Policy No | Provide the policy number for your flood policy. You can find this number on your policy’s declarations page, and oftentimes in correspondence with your adjuster or insurance agent. |

| Claim/File No | This is the claim number that was assigned to your claim after it was filed. You should have noted this at the very beginning of your claim communications with the insurance company, and/or you can find this claim number on most correspondence exchanged during the claim. |

| Date of Loss | The date when the flood occurred. |

| Time of Loss | Provide the street address (and the city, state, and zip code in accompanying fields) for the insured and damaged property. |

| Property Address | Provide the street address (and the city, state, and zip code in accompanying fields) for the property that is insured and damaged. |

| Mailing Address | Provide the best mailing address, which is the place where you can best receive mail. This is an important field because your insurance company will send claim communications to this address. For this field, you need to choose from the provided dropdown menu as to whether the address is: The same as your property/insured address, or if you have a “temporary” mailing address, or a “permanent” mailing address. |

| Phone No | Provide the best telephone number for the insurance company to reach you. |

| How flood loss happened | Here, select from one of the provided options to identify how you think the flood loss happened. The options are: 1. Unusual and rapid accumulation or runoff of surface waters from any source 2. Overflow of inland or tidal waters 3. Mudflow from loss of brush cover and excessive rain 4. Water containment system break, backup or release (e.g. dam, reservoir, levee, water supply, or sewer system) 5. Land collapse/subsidence along a shore from erosion/undermining caused by waves/current > anticipated levels 6. No flood damage (Loss Avoidance Measures Only) |

| Interest Morgagee(s) | Identify the name(s) of any company(ies) that holds a mortgage on the property. If you don’t have any mortgages, select “None.” |

| Interest Other(s) | Here the form asks you to identify the name(s) or any people or company(ies) with liens, charges, or claims against the property, if any. If you don’t have any, select “None.” |

| Interest Other Insurance | Here, FEMA is interested in learning about other insurance on the property. You can select the type of insurance you have from the dropdown menu, which includes options of Renters, Homeowners, Windstorm, Earthquake, Builders Risk, Condominium, Commercial Property, Self-Insured Municipality, Mobile Home, Private Flood, and None. In addition to selecting from the dropdown, write down the name of the other insurance company in the provided area. |

| Title & Occupancy Building Type | The form asks you to identify which type of building is insured. Choose your building type from the dropdown. The options include Residential single-family dwellings, residential 2-4 family buildings, Residential multi-family (5 or more) buildings, Residential multi-family (mixed-use) buildings, Residential condominium buildings, Non-residential buildings (business), and Non-residential buildings (other than a business). |

| Title & Occupancy Ownership/Use | The form asks you to identify how you – the policyholder – occupy the building. Choices are owner-occupied (principal residence), owner-occupied (seasonal residence), owner-occupied (commercial use), owner-occupied (municipal use), owner-unoccupied, and tenant-occupied. |

| Title & Occupancy Contents Type/Ownership/Use | While the other two sections under “Title & Occupany” seek information about the building itself, this third field seeks information related to the contents. If you don’t have any insurance on your contents you can choose the first option in the dropdown, which is “I did not purchase coverage for contents.” If you do have coverage, you’ll want to choose from the other options, which are: – Residential contents ar owned solely by me – Residential contents are owned by me, household family members, and/or guests/servants – Residential contents are owned in common by the unit owners of my condo association – Non-residential contents are owned in common by the unit owners of my condo association – Non-residential contents are owned solely by me – Non-residential contents are not owned solely by me but are leased via a capital lease |

| Coverage – Building Property | In these three important columns, you are identifying the amount of insurance you have and the amount of your claim for the Building. In the first column, specify the “Amount of Coverage” you have in the insurance policy. For NFIP policies, this can be an amount up to $250,000. You’ll find this on your declarations page. In the second column, identify your “Deductible,” which should also be shown on your declarations page. In the third column, you should identify the amount you claim for the flood damages. This is the total amount of flood damages to the Building MINUS your deductible…up to the coverage limits. |

| Coverage – Personal Property | In these three important columns, you are identifying the amount of insurance you have and the amount of your claim for the Personal Property, or in other words, your Contents. In the first column, specify the “Amount of Coverage” you have in the insurance policy. For NFIP policies, this can be up to $100,000. You’ll find this on your declarations page. In the second column, identify your “Deductible,” which should also be shown on your declarations page. In the third column, you should identify the total amount you claim for the flood damages to your contents. This is the total amount of flood damages to the Contents MINUS your deductible…up to the coverage limits. |

| Net Amount Claimed | Add up the Amount Claimed for Building and the Amount Claimed for Personal Property to create a total/net amount claimed. |

| Requirements For Submitting A Complete Proof of Loss | Check off all the boxes that apply to you and how you prepared the Proof of Loss. Everyone should check the first box, indicating they used their own “judgment concerning the amount of any loss.” The Standard NFIP policy’s VII(G)(5) specifically provides that “in completing the proof of loss, you must use your own judgment concerning the amount of loss, and justify that amount.” Therefore, even though you’re likely relying on experts, estimates, adjusters, and other third-party information, which can all be a little misleading, you should check this first box to comply. And since you also need to “justify” that amount, everyone should also check the second box. As to the other 3 sub-checkboxes, here you should select the ones that apply based on what you are submitting with your proof of loss filing. |

| Policyholder Signature | A policyholder should sign in this field. |

| Date Signed | If the “Owner Name” is an entity, print the title of the person who signed for the owner as “Policyholder.” |

| Owner Name | Print the name of the property owner(s) |

| Owner Title | If the “Owner Name” is an entity, print the title of the person who signed for the owner as “Policyholder.” |

The FEMA “Building and Contents” Proof of Loss form is straightforward and simple. As we suggested earlier in this article, NFIP Policyholders are wise to use the FEMA-provided form because it’s quite simple and will definitely get accepted.

However, the form has some peculiar features that frustrate me.

- References Incorrect Policy Provision: The FEMA form’s introduction says policyholders can use the form as the “policyholder’s statement of the amount of money being requested, signed and sworn to by the policyholder, with documentation to support the amount request, as required by the Standard Flood Insurance Policy (SFIP) in VII.J.4.” The reference to VII.J.4. was correct before October 2021. However, since October 2021, the proof of loss requirements can be found in VII.G.4.

- Refers To “Servants!?”: This is extremely weird to me. In the “Title and Occupancy” section related to contents ownership, one option is to state that the contents are owned by “servants.” Really? Servants?!

- Personal Property v. Contents: I don’t like how the form uses two separate terms for the same thing, referring to both “Contents” and “Personal Property.” These are the same thing, so don’t let that confuse you.

- Messy Signature Line: The signature line of this form is more confusing than it needs to be. It asks for the “Policyholder Signature” and then asks the form-filler to put the “Owner name” and the “Owner title.” This is unnecessarily confusing. If you’re filling out this form, sign it and type your name under “Owner name.” You can use “Owner title” only if the policyholder/owner is a business entity, in which case you can highlight the title of whoever signed the document (i.e., President, etc.)

- The Form Asks For Too Much Information!!! Finally, and this is a big one, I think the FEMA form unfairly asks the policyholder for too much information. Section VII.G.4 of the policy is very explicit about what must be in a Proof of Loss, and I think the form should be limited to that information.

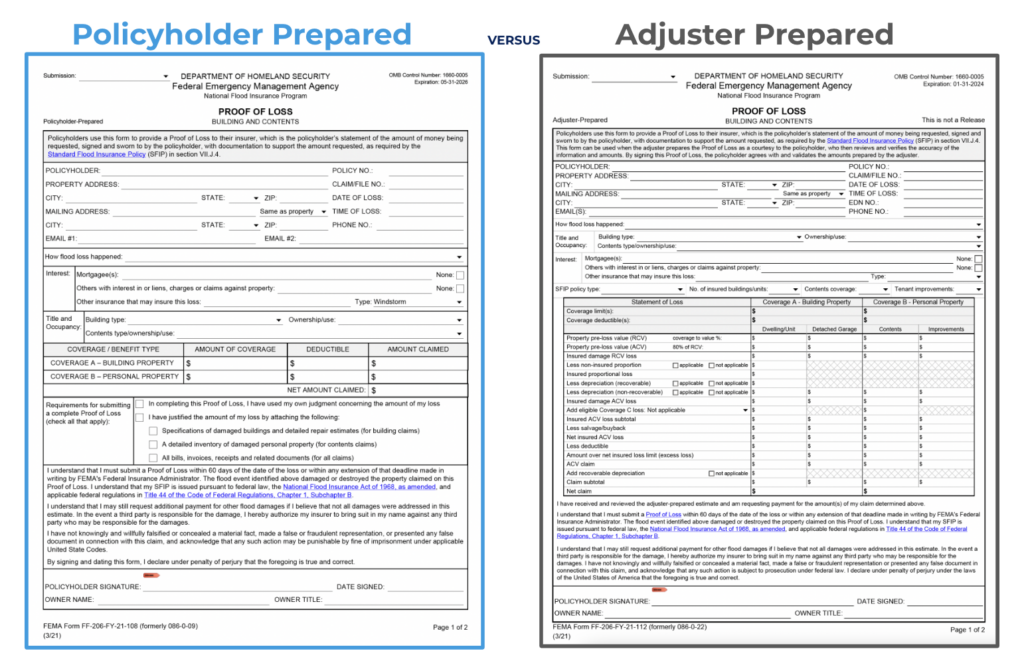

“Adjuster Prepared” v. “Policyholder Prepared” Forms

FEMA publishes two different Proof of Loss forms. One is the “Policyholder Prepared” form. The other is the “Adjuster Prepared” form. These two forms are materially different and policyholders should pay attention to the differences.

Why Do Two Different Forms Exist?

Standard Flood Insurance Policy provision VII.G.7 is why the “adjuster provided forms” exist.

This provision states:

The insurance adjuster whom we hire to investigate your claim may furnish you with a proof of loss form, and she or he may help you complete it. However, this is a matter of courtesy only, and you must still send us a proof of loss within 60 days after the loss even if the adjusted does not furnish the form or help you complete it.

What is going on here?

As you likely know, an insurance adjuster (working for the insurance company) will get assigned to your claim after it’s filed. This section of the insurance policy says that the insurance adjuster may create the proof of loss document for you…but, since the insurance adjuster may not, and since you are supposed to “use your own judgment” in creating the proof of loss, the SFIP qualifies that this form-creation work will be done by the adjuster “as a courtesy only.”

This is a very strange provision.

I’ve never seen something like this in any other type of insurance policy or contract. It’s surprising to me that there is so little case law, blog articles, or other references to this. In general, it seems like flood insurance adjusters sometimes create the proof of loss form as a “courtesy,” and sometimes they don’t, and that’s that.

Nevertheless, this is why the two different forms exist.

The two forms are different, and the “adjuster prepared” form creates some policyholder risk that should be considered.

Key Differences Between Adjuster & Policyholder Prepared Forms

FEMA publishes two different Proof of Loss form. One is a “Policyholder Prepared” form that is discussed throughout this guide (and is the form I recommend you use). The other is an “Adjuster Prepared” form that is supposed to be used by insurance adjusters who fill-in the form for the policyholder “as a courtesy.”

These two forms have clear differences, and key differences are listed here:

- Adjuster Prepared Form Gets Policyholder to State “Agreement” With Adjuster: The biggest and most consequential difference is right at the top of the form, which provides that “By signing this Proof of Loss, the policyholder agrees with and validates the amounts prepared by the adjuster.” This is a huge statement we discuss further in the next section. While the adjuster is just preparing the POL as a “courtesy,” the policyholder is definitely not just signing as a “courtesy.” The policyholder is hitching their wagon to everything represented by the adjuster. Because the adjuster form is more detailed than the policyholder form, the policyholder agrees to quite a lot.

- More Detailed About Losses: Another key difference is the degree of detail provided in the form. While the Policyholder Prepared form simply identifies the “Amount of Claim” for the Building and Contents in 2 fields, the Adjuster Prepared form outlines the damages across 54 different fields! These fields provide opinions and conclusions on replacement cost value, actual cash value, salvaged amounts, depreciation, “proportional losses,” and more.

Why You Should Use The Policyholder Prepared Form

Generally speaking, it’s a best practice for policyholders to submit the Policyholder Prepared Form.

When you sign the Adjuster Prepared form, you’re unnecessarily agreeing to many different claim details. This includes agreeing to the value of the losses, which is a problem because flood insurance adjusters commonly undervalue flood losses. Furthermore, because the Adjuster form is so detailed, there may be a lot of information on the form that you don’t fully understand. In sum, you’re submitting a lot more information under oath than necessary. There are zero good reasons why you should do this.

I like how United Policyholders explains this: “Even if your insurance adjuster already had you sign and submit a Proof of Loss, that form may be deemed ‘courtesy only,’ and chances are it undervalued your loss, especially if you submitted it early on.”

If you’re presented with an “Adjusters Prepared” form — that’s fine. Take the high-level information in that form and copy it into the Policyholder Prepared Form (which you can get here free). Send that one instead.

Sign & “Swear To” the Proof Of Loss Statement

The Standard Flood Insurance Policy does not mandate a specific format for the Proof of Loss statement. This is reiterated throughout case law, including a seminal case on federal flood policy restrictions, DeCosta v. Allstate Ins. Co (730 F. 3d 76) Court of Appeals, 1st Circuit, 2013.

The DeCosta court makes it clear while a specific form or format it not required…it is a requirement that the Proof of Loss be a statement that is “signed and sworn to.”

While the SFIP does not require that a proof of loss follow any particular format, it ‘define[s] a proof of loss as a statement of the insured, not of some third party, and it does require that the insurer sign and swear to that statement.’

In the DeCosta case, the policyholder submitted a letter and a contractor’s estimate of the damages. It wasn’t enough.

The federal courts are very, very strict about policy terms in federal flood insurance policies.

The DeCosta court explains that federal insurance policies “are not an ordinary insurance policy” but are actually “codified regulations” and a “matter of federal law.” And further, “federal law mandates strict compliance with the Standard Flood Insurance Policy, including its proof of loss requirement.“

So, not only must policyholders meet the strict 60-day deadline, but they must also make sure the “proof of loss” meets policy requirements. And one key part of that requirement is that the policyholder makes a “statement,” that the statement is “signed,” and the statement is “sworn to.”

The policyholder could venture out and create their own Proof of Loss form, but the FEMA form is a safe harbor. If they use this form and sign it, it has the “swear to” language that will certainly be accepted by the courts. The form does not need notarization, but it does need to be signed and include “sworn to” language.

In addition to the statement, signature, and “swearing to,” and including all the necessary fields, the Proof of Loss form must also be accompanied by supporting materials.

Attachments, Documents, and Supporting Material Required To Submit With POL

A successful Flood Proof of Loss requires more than just filling in and submitting a signed form. Your flood policy has a few specific proof of loss requirements beyond the form itself. The policy specifically requires the below:

- “Justify” Your Amounts: Section VII.G.5 states, “in completing your roof of loss, you must use your own judgment concerning the amount of loss and justify the amount.” This second element — and justify the amount — generally requires policyholders to reference other materials that they used to determine the scope and cost of losses.

- Detailed Repair Estimates: Section VII.G.4(f) — the “Proof of Loss” provisions — specifically requires, as part of the proof of loss itself, the policyholder to furnish “specifications of damaged buildings and detailed repair estimates.”

- Inventory of Damaged Contents: Section VII.G.4(i) requires policyholders also submit “the inventory of damaged [contents],” referring VII.G.3, which further requires “an inventory of damaged property showing the quantity, description, actual cash value, and amount of loss…[attaching] all bills, receipts, and related documents.”

- Proof of Loss Form Checklist Items: Finally, the FEMA-provided Proof of Loss form itself enumerates three different types of documentation that the policyholder can provide, including (1) Specifications of damaged buildings and detailed repair estimates for building claims; (2) detailed inventory of damaged personal property for contents claims; and (3) All bills, invoices, receipts, and related documents, for both building and contents claims.

Policyholders can prepare their documentation on their own and submit it with any proof of loss documentation. The federal laws do offer some flexibility as to what constitutes “justification” of the amounts due, what is an “inventory of damaged contents,” and what are “detailed repair estimates.”

FEMA has given some guidance to policyholders through “documentation checklists” available on their website (see: Use Documentation Checklists to Help You Complete Your Proof of Loss Form).

As to Contents/Personal Property, FEMA recommends providing:

- Photos of damages before and after

- Itemized contents inventory with estimated costs and/or quotes for each item

- For individual items worth >$1,000, also provide: Receipts for replacement, estimates or quotes for comparable item(s), credit card or bank statement showing replacement costs, warranty registration with product manufacturer, and/or appraisal documentation for any antiques or rare items.

FEMA provides a “Contents Inventory Worksheet” that you can download for free and use to provide this itemized information.

As to Building Home & Structure Repair, REMA recommends providing:

- Photos of damages before and after

- One of the following if repairs will be through Contracted Services: (i) Receipts, invoices, or contractor estimates for repairs or replacement; (ii) Insurance estimate; (iii) Credit card or bank statement showing repair or replacement costs

- As much as possible of the following if you’ll do DIY Repairs: (i) Receipts or invoices of rental equipment used, including fuel and maintenance costs; (ii) Receipts or invoices for any supplies; (iii) Estimated time spent on removal or repair.

FEMA provides a “Building Repair Worksheet” that you can download for free and use to provide this itemized information.

Conclusion

Navigating the Proof of Loss process for flood insurance claims can be challenging, but with the right knowledge and tools, you can ensure your claim is handled efficiently and accurately.

Understanding the specific requirements and deadlines when purchasing an NFIP flood insurance policy is crucial to avoiding delays and denials.

By following this guide, gathering the necessary documentation, and submitting a detailed and timely Proof of Loss, you can streamline the claims process and increase the likelihood of a fast and fair settlement. Remember, proactive communication with your insurer and meticulous record-keeping are key to successfully managing your flood insurance claim.